The disturbing lessons from Panama Papers that have lasting repercussions worldwide for governments, companies, trusts, individuals, not to mention their accountancy and legal advisers, that are shaping a fundamental review of the longstanding principle of taxpayer confidentiality

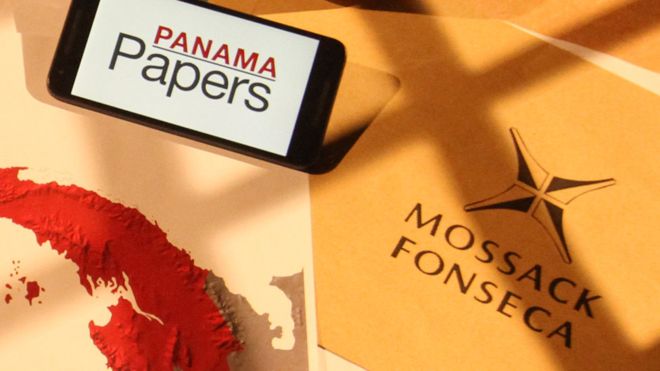

This conference will address the effect of a massive leak of offshore account documents, as many as 11.5 million files from Panama-based law firm Mossack Fonseca. The Panama Papers leak sheds some light on the intricate ways in which the wealthy can exploit secretive offshore tax regimes as well as a signal warning of illicit financial flows and capital flights to offshore jurisdictions that wreak serious economic impact and depress tax revenues that could be made available for infrastructure and economic progress. This conference provides a platform to share perspective and insights on the understanding of offshore tax havens, preventing tax evasion and the disturbing lessons from the Panama Papers in order to strengthen the global resolve to enforce tax compliance, including taking a closer look at inventing new modern transparency tools and creating financial registries to manage the problem of tax evasion, as well as an initiative towards a well-functioning tax system and creating a global financial audit.